Quite a few readers asked me about investing in hospitality trusts and they usually ask me about FEHT or CDL HT.

This is not surprising because they have a stronger presence in Singapore.

I don't have a stake in either and with the oversupply of hotel rooms in Singapore, it is probably the case that hospitality trusts with a bigger exposure in Singapore will continue to struggle.

Beyond this, I don't have anything more specific to say about the trusts.

Having said this, I do have a good size investment in a hospitality trust, namely, Ascendas Hospitality Trust (AHT).

Newer readers might not know this but I first invested in AHT in 2014.

I did not invest in AHT during its IPO as I found the financial engineering to boost DPU distasteful. You can read more about this in related post #1 at the end of this blog.

Back in 2014, I thought that Mr. Market offered me a pretty reasonable price to invest in AHT, a price which was about 20% lower than its IPO.

With the effect of financial engineering expired, it was also clearer what my return on investment realistically was going to be. A distribution yield of 7.64% was attractive enough, I thought.

In August 2015, when AHT's unit price suffered from a severe bout of market pessimism, I was pleased to accept Mr. Market's offer to increase my investment in AHT.

Purchases in that month grew my nibble of an investment in AHT in 2014 to a much more significant position, large enough to generate enough passive income to replace a month's worth of earned income (when I was still gainfully employed).

My investment in August 2015 would receive a distribution yield of more than 9.5% based on the numbers I used for my purchase in 2014.

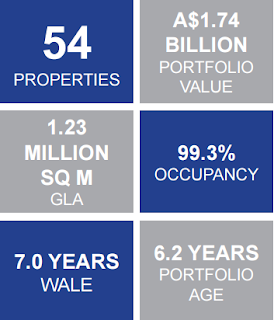

AHT has a portfolio of hotels in Australia, China, Japan and Singapore. However, its exposure to Singapore is limited to one hotel, Park Hotel Clarke Quay which was purchased in 2013.

So, the effect of oversupply in hotel rooms here will have less negative impact on their results overall.

Most of AHT's assets are in Australia which contribute 56% of Net Property Income (NPI). Japan is the second largest contributor accounting for 24% of NPI.

The much stronger performance by these assets more than compensate for poorer performance in Singapore.

Year on year, 3Q's DPU improved by 13.1% to 1.64c as a result.

Gearing is at 33.3%. NAV/share 85c.

In 2014, I said that an appreciation in the A$ would benefit AHT. Together with the stronger JPY, I am hopeful that DPU for 4Q could similarly receive a boost.

The oversupply in hotel rooms in Singapore was already apparent in 2014 and AHT was probably a better choice than FEHT or CDL HT. I was lucky to make the right choice.

|

| Source: SBR, 20 Mar 14. |

Despite the oversupply of hotel rooms in Singapore, I expect AHT to be a better passive income generator for me this year.

|

| Unit price declined 16.4% from $1.645 (15 Sep 14) to $1.375 (10 Feb 17). |

|

| Unit price declined 27.6% from 81.5c (15 Sep 14) to 59c (10 Feb 17). |

|

| Unit price rose 3.4% from 73c (15 Sep 14) to 75.5c (10 Feb 17). |

Download presentation slides: HERE.

Related posts:

1. AHT: A nibble.

2. 9M 2015 income from non-REITs.