AK did not get to be lazy in 4Q 2022 as reallocation of resources continued in the quarter.

2022 has turned out to be quite a demanding year.

In equities, I reduced exposure to a plethora of stocks to raise funds to increase exposure to the local banking sector.

This is consistent with what I shared in a blog published in the middle of October.

See:

DBS, OCBC and UOB at 40% of portfolio.

The banks are in a good place to enjoy a strong tailwind provided by rising interest rates.

Even in a recession, the banks should continue to bring home the bacon as they are well capitalized and should have no problem paying dividends.

Nothing was sacrosanct in the reallocation exercise and several very small positions in my portfolio were closed down while some larger positions were reduced in size.

Apart from OCBC and UOB, I could not resist increasing the size of my investment in IREIT Global as the fundamentals remain sound and the REIT's unit price hit what I felt to be distressed levels.

It would be impossible to buy any asset owned by IREIT Global at about 40% discount to valuation but we could if we bought some of IREIT Global from mid 3Q to 4Q 2022.

To be fair, that 40% discount to valuation could reduce somewhat as the REIT is going to take some time to backfill the space at Darmstadt vacated by Deutsche Telekom.

The valuation of that particular property could come under pressure, therefore.

However, if we are investing in properties for the longer term and we should be, it isn't a tragedy that it might take some time to see results as the space will be leased out eventually.

IREIT Global has the most defensive financials I can find amongst the REITs which I own while offering a distribution yield of around 8%.

With the accumulation of IREIT Global in 4Q 2022, it is my largest investment in the S-REIT universe today.

See:

IREIT Global: Short term pain.

I also added to my investment in Wilmar International as the business became more profitable in spite of a challenging environment.

In the worst case scenario where we see stagflation, I have an inkling that Wilmar International could outperform as the world faces a food crisis.

I nibbled at LION-OCBC Hang Seng Tech ETF as it overshot the low formed on 15 March 2022 but like I said in an earlier blog, it would likely be the last time I added to my position in the ETF as I am not too keen on trading regularly in order to make money.

Too lazy.

I did subsequently reduce exposure when the unit price rebounded in November.

I reduced exposure again in early December as the ETF's unit price rose to test resistance provided by the descending 200 days moving average which was approximately at 71c:

See:

Hang Seng tech ETF: BUY or SELL?

Those couple of trades produced a capital gain of around 23% and reminded me of why I spent so much time trading the stock market many years ago.

Some readers might remember that I shared in my blog as well as during one or two "Evening with AK and friends" that I made around half a million dollars in my adventures as a stock trader many years ago.

Trading stocks could be financially more rewarding than investing for income but it requires more activity and some knowledge of technical analysis.

I have decided to become more laid back in recent years to spend time on other things in life.

Anyway, the average price for my remaining position in the ETF is probably low enough to make Chinese tech stocks look cheap even to value investors.

A simple reversion to mean would result in a capital gain for me.

I do not need to see euphoria and the ridiculously high valuations when the market was sloshing with almost free money in order to have a good result here.

However, it is a tiny position in my portfolio and it would not move the needle much.

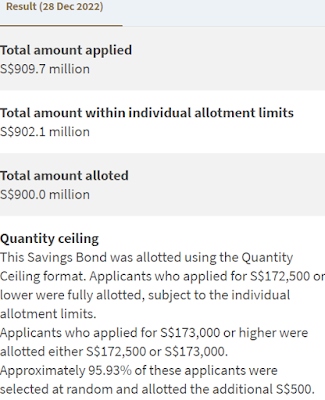

In bonds, I have put money earmarked for contribution to my CPF account into Singapore Savings Bonds (SSBs) while money from maturing fixed deposits went into Singapore Treasury Bills as yields of these government bonds reached levels which I found to be more attractive.

Blogs on SSBs and Singapore Treasury Bills:

1. SSB 2.44x oversubscribed (27 Oct.)

2. 4.19% yield on T-bill!(28 Oct.)

3. 3.47% 10 yr average yield! (1 Nov.)

4. 3.47% p.a. fully allotted (28 Nov.)

5. 4.4% yield on T-bill!(9 Dec.)

6. 4.28% 6 mths T-bill. (21 Dec.)

7. SSB: Mission accomplished.

The changes made in 4Q 2022 to my investment portfolio is consistent with what I have said many times before and that is not to be overly optimistic nor overly pessimistic but to stay pragmatic.

Having a percentage of my portfolio in fixed income like SSBs and Treasury Bills now while staying invested in equities which I feel will likely outperform fixed income (including my CPF savings) in the longer term should result in a more resilient investment portfolio.

If I feel that equities would outperform in the longer term, why am I still putting money in fixed income?

It is about having peace of mind as an investor.

Fixed income instruments are important for investors who cannot afford or at least feel that they cannot afford to be too adventurous as fixed income helps in reducing the volatility in our portfolio.

Not everyone is able to stomach greater volatility, whether it is due to a lack of financial ability or mental strength to do so.

Now that yields are reasonably attractive, they also help to reduce the cost of insurance that is the opportunity cost of not getting possibly higher returns.

There were times when I was very adventurous as an investor and I was fortunate to be well rewarded many times but I also suffered losses sometime.

The emotional roller coaster that came with being more adventurous wasn't a lot of fun either.

Anxiety and depression are only interesting topics to psychiatrists.

See:

1. Peace of mind as an investor.

Having said this, I am also partial to fixed deposits which offer relatively high interest rates as I continue to maintain a meaningful cash position which is mostly my emergency fund and float.

This cash position has helped to keep me sane during bad times and it still does.

What about the opportunity cost of not being invested?

Ahem.

Do you believe in insurance?

I do.

I know that some people don't.

The cost of insurance is worth it, in my opinion.

See:

4% p.a. 6 months fixed deposit.

What about my war chest?

There isn't much left in my war chest as the funds have been substantially deployed.

Well, regular readers would have an inkling that there wasn't much in my war chest to begin with as I lack an earned income and consume most of my passive income.

See:

Inflation, passive income and budget.

Sadness.

Even the government takes pity on me and gives me money every year.

Anyway, enough of self pity.

So, how much passive income did my portfolio generate in 4Q 2022?

S$ 25,331.81

It is a relatively small sum compared to passive income in 3Q 2022.

However, to put things in perspective, 4Q 2021's passive income was:

S$ 21,283.82

So, year on year, 4Q 2022's passive income came in 19% higher.

Looks more impressive percentage wise but I get it that the dollar value increase is smaller compared to 3Q 2022 which saw a smaller percentage increase at less than 10% improvement, year on year.

4Q 2022 passive income includes income received from 6 months Treasury Bills which I started buying only in October.

This new passive income component is a relatively small trickle but every little bit helps.

My passive income for the whole of 2022 is:

S$205,999.73

This is almost 20% higher when compared with S$171,854.30 generated in 2021.

Average passive income per month in 2022 was about:

S$17,166 per month.

Can't really complain.

I am contented.

Now, I ask an important question.

What is 2023 going to be like?

It is more likely than not that recession is coming to many parts of the world even as we get used to the idea that higher inflation is going to stay with us for some time to come.

So, with inflation high and economic growth evaporating thanks in part to rapidly rising interest rates, we could also see stagflation.

Therefore, I would be quite happy if my passive income in 2023 is similar to 2022, give or take a few percentage points.

Not going to raise the bar as I could be disappointed.

What else am I telling myself?

As an investor for income, I cannot dictate how much my companies should pay me but I can certainly tell myself how to spend my money.

What to do?

Will have to tighten my belt.

Buckle up for a bumpy ride.

Don't throw caution to the wind.

Hold on tight to our emergency funds for dear life!

See:

50% do not have enough savings!

I continue to remind myself that fixed income investments are more attractive than before.

Having a meaningful percentage of risk free and volatility free T-bills and SSBs in my portfolio is not a bad idea.

The CPF might not be as sexy a "fixed income" instrument but it isn't wrong to keep thinking of it as an investment grade bond with a significant annuity angle.

The CPF still works as a risk free and volatility free investment grade sovereign bond which helps to provide a greater degree of certainty when it comes to retirement funding.

These fixed income options help to form the large base of my investment pyramid.

See:

Motivations and methods in investing.

I also remind myself the importance of staying invested in bona fide income generating businesses which generate meaningful and sustainable income for us.

Getting rich slowly isn't as sexy as getting rich quickly but like I said before, the journey to financial freedom is not a race: HERE.

In summary, for regular folks, don't be too adventurous as having strong and reliable cashflow is important.

To be clear, it has always been important but with heightened rising costs in so many forms and much greater economic uncertainty, it is probably more important than ever.

Focusing on our portfolio's ability to generate income and not our portfolio's market value (now or in the future) might not be a bad idea.

Remember, I prefaced these highlighted paragraphs with the words "for regular folks."

If you are a very rich or "jin satki" person, it might not apply to you.

If you are not very rich or "jin satki" but act like you are, good luck to you.

Very rich people can take a few hard knocks and still survive.

For example, they could lose a few hundred thousand dollars or more in Tesla or Alibaba but still stay rich.

Those who are not very rich might find themselves in financial distress especially if they had borrowed money to do the same.

Peace of mind is priceless.

2023 is likely to be a relatively difficult year for most regular folks.

Stiff upper lip and stay the course.

As long as we are moving in the right direction, we should make incremental improvement and move towards financial freedom.

Discipline and patience will be rewarded.

All in good time.

Happy New Year.

References:

Growing passive income: Equities, CPF and bonds.

3Q 2022 passive income: Stunned!

4Q 2021 passive income: Don't lose hope!