It has been a while since I last published a blog like this.

I have been lazy.

So, what's new, right?

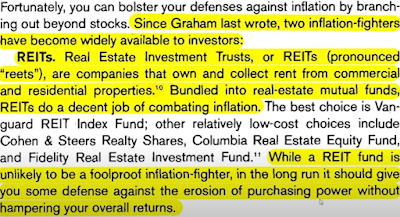

In my defense, I did publish a couple of blogs on my largest REIT investments.

For example:

Largest REIT investments updated.

Anyway, readers who have been following my blogs regularly probably will not get much out of this blog.

They would already have a rough idea how my investment portfolio has morphed in the last 2 years or so and also the reasons why.

For what it is worth, here is a quick update.

$500,000 or more:

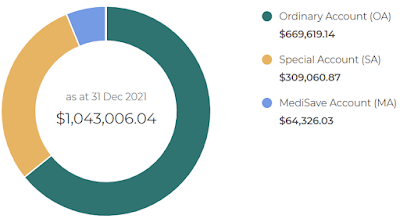

CPF

Yes, I know that some will laugh at this.

It is OK because I am laughing too.

Laughter is good for our health.

So, laugh away, whatever the reason. ;p

See:

$1.1 million in CPF savings.

My CPF savings is the investment grade bond component of my portfolio.

It is my ultimate safety net.

From $350,000 to $499,999:

AIMS APAC REIT

IREIT Global

This bracket welcomes a new member, IREIT Global.

AIMS APAC REIT is my longest lasting top investment and has witnessed all the changes in my portfolio.

It sounds a bit spooky when I put it this way.

Absolutely free of cost for quite some time already, it is still generating good income for me.

I hope IREIT Global will be good to me in a similar fashion too.

Time will tell.

New readers might be interested in this blog:

AIMS APAC REIT or IREIT Global?

From $200,000 to $349,999:

ComfortDelgro

Centurion Corporation

DBS

OCBC

UOB

Wilmar International

ComfortDelgro is the weakest position in this bracket no thanks to the pandemic but even with the huge decline in its share price, the market value of my investment is still above $200,000.

I do expect things to improve from here.

See:

ComfortDelgro: AK replies to comments.

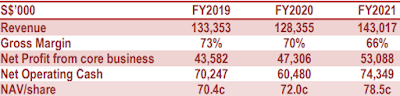

Centurion Corporation is a much larger investment for me today and it is close to being promoted to the next bracket.

I blogged about Centurion Corporation recently and if you don't remember, see:

1Q 2022 passive income.

Like ComfortDelgro, I expect things to improve from here for Centurion Corporation.

UOB is a new member in this bracket as I only became invested in the bank during the last bear market.

My investments in DBS, OCBC and UOB are very close to being promoted to the next bracket as their market values have ballooned.

I have not added to my positions since the last bear market.

So, this is mostly due to the higher prices of their common stock.

To reduce my reliance on REITs for income, building long positions in all three local banks has proven to be rewarding thus far and I hope it continues to be so.

See:

Higher dividends from DBS, OCBC and UOB.

Wilmar International is another new member in this bracket.

More accurately, it is a returning member.

Wilmar moves into this higher bracket mostly for the same reason as the banks.

Its share price has appreciated meaningfully.

Still undervalued even though its share price is much higher now, it could possibly go higher.

Of course, it could also stay undervalued.

From $100,000 to $199,999:

Sabana REIT

Sabana REIT is my one and only investment in this bracket now.

The REIT returned as one of my largest investments in late 2020 after the low ball offer by ESR REIT was rejected.

Having activist investors on my side is very reassuring.

I look forward to more value being unlocked.

See:

Sabana REIT to the rescue.

As promised, this is just a quick update.

OK, maybe, I will nag a little.

Remember, AK does not wear a coat.

So, no coattail to ride on.

Riding on coattails can be very dangerous especially if we do not have insurance. ;p

References:

1. Largest investments updated (4Q 2019).

2. Investing with some common sense.

Recently published:

Lying flat...