Regular readers know that I strongly believe in the CPF system.

PRIVACY POLICY

Featured blog.

1M50 CPF millionaire in 2021!

Ever since the CPFB introduced a colorful pie chart of our CPF savings a few years ago, I would look forward to mine every year like a teena...

Archives

Pageviews since Dec'09

Recent Comments

ASSI's Guest bloggers

- ENZA (3)

- EY (7)

- Elsie (1)

- Elvin H. Liang (1)

- FunShine (5)

- Invest Apprentice (2)

- JK (2)

- Jean (1)

- Kai Xiang (1)

- Kenji FX (2)

- Klein (2)

- LS (2)

- Matt (3)

- Matthew Seah (18)

- Mike (6)

- Ms. Y (2)

- Raymond Ng (1)

- Ryan (1)

- STE (9)

- Serejouir (1)

- Solace (13)

- Song StoneCold (2)

- TheMinimalist (4)

- Vic (1)

- boon sun (1)

- skipper (1)

Resources & Blogs.

- 5WAVES

- AlpacaInvestments

- Bf Gf Money Blog

- Bully the Bear

- Cheaponana

- Clueless Punter

- Consumer Alerts

- Dividend simpleton

- Financial Freedom

- Forever Financial Freedom

- GH Chua Investments

- Help your own money.

- Ideas on investing in SG.

- Invest Properly Leh

- Investment Moats

- Investopedia

- JK Fund

- MoneySense (MAS)

- Next Insight

- Oddball teen's mind.

- Propwise.sg - Property

- Scg8866t Stockinvesting

- SG Man of Leisure

- SG Young Investment

- Sillyinvestor.

- SimplyJesMe

- Singapore Exchange

- Singapore IPOs

- STE's Investing Journey

- STI - Stocks Info

- T.U.B. Investing

- The Sleepy Devil

- The Tale of Azrael

- TheFinance

- Turtle Investor

- UOB Gold & Silver

- Wealth Buch

- Wealth Journey

- What's behind the numbers?

CPF account is recovering almost $700K. Thoughts.

Tuesday, January 30, 2024Posted by AK71 at 9:35 AM 14 comments

Labels:

CPF,

money management

My plan after 3.45% p.a. 1 year T-bill.

Friday, January 26, 2024

Massive disappointment.

Many felt that when the cut-off yield came in at 3.45% for the latest 1 year T-bill auction.

I somehow got the dates messed up and I couldn't take part in the auction.

Regular readers might remember that I bought a 1 year T-bill about a year ago using CPF-OA money.

That cut-off yield was 3.87% p.a. and would mature on 30 January 2024.

So, it would not have matured in time for the recent 1 year T-bill auction.

Somehow, I kept thinking that it would.

Anyway, no loss there.

3.45% p.a.

I would not have gotten the T-bill even if the money came back in time.

I would have placed a competitive bid of 3.5% p.a.

That is minimally acceptable to me when using CPF OA money to buy T-bills.

This is because the breakeven is 3.33% p.a.

This covers the possibility of losing 8 months of CPF OA interest and not just 7 months.

So, at 3.5%, I am only getting 0.17% more than what CPF OA would pay me.

This means that for $100,000, it is a $170 difference.

For $670,000, which is the amount from my last 1 year T-bill with CPF OA money, the difference would have been about $1,140.

Nothing to write home about but still something.

Of course, getting 3.87% the last time, the difference was more significant.

Anything lower than 3.5% p.a., I would just leave the money in the CPF-OA.

Not enough meat for me to be interested.

So, what am I doing with the CPF OA money coming back?

I will try for 6 months T-bill, bidding competitively at 3.5% p.a.

If I don't get it, no big deal.

If AK can talk to himself, so can you.

Reference:

CPF account got hacked!

Posted by AK71 at 9:54 AM 10 comments

Reducing risk and volatility on portfolio level.

Monday, January 15, 2024

I have picked up Yu Gi Oh again!

Found that I could play it for free online.

It was something I played but only for a bit and I enjoyed the anime.

I didn't have a deck of my own as it was too expensive to build one.

I had to use a friend's deck.

It was so long ago.

Old brain.

So rusty.

It is a strategy game that really tests my ageing brain which is a good thing.

Helps to slow the onset of dementia, maybe.

Anyway, like I said in a previous blog post, I have been contemplating just buying T-bills and bonds from now on.

Of course, if the yields decline, I could always go back to making contributions to my CPF account.

Regular readers know that I treat my CPF savings as an investment grade bond component of my portfolio which pays reasonably attractive coupons.

This way, I would continue to grow the risk free component of my investment portfolio.

I must realize and embrace the fact that I don't really have to take on more risk anymore although I could still buy more stocks if Mr. Market goes into another severe depression.

Like I said several times before, that would be the time to dismantle my T-bill ladder.

Doing this, buying T-bills and bonds in the meantime, price volatility on the portfolio level would reduce over time.

The last T-bill auction saw a cut-off yield of 3.74% p.a.

Until the Fed reduce interest rate, I am expecting similar cut-off yields for the time being.

I have put in a non-competitive bid for the upcoming auction happening on this Thursday, 18th of January.

That's all for this update.

If AK can talk to himself, so can you!

Related post:

SSB, T-bills, banks and plan.

Posted by AK71 at 11:08 AM 13 comments

Labels:

bonds,

passive income

4Q 2023 passive income: Why the smile?

Wednesday, January 10, 2024

In my first blog post of the year, I said that 4Q 2023 passive income should come in weaker.

This is because OCBC and UOB only pay dividends in Q2 and Q3.

So, missing these major contributors, it is only reasonable to expect lower passive income numbers for me in Q4 2023.

Also, I expected Q4 2023 passive income to be lower, year on year.

This is because my investments in REITs and property developers were generating less income for me in 2023 compared to the year before.

High interest rates are pretty challenging for some entities.

Fortunately, DBS pays dividends quarterly.

Being another substantial investment in my portfolio, hopefully, this would provide a bit of a cushion.

This is especially when DBS increased their dividend per share not too long ago.

My persistence in building and strengthening a T-bill ladder in an environment of higher yields should also help.

All of that went on in my head.

So, how did things turn out?

Total passive income generated by my investments in 4Q 2023 was:

$ 24,849.44

This is some 2% lower, year on year.

It was $25,331.81 in 4Q 2022.

Hmm, the decline was not unexpected.

Still, like the title says, I smiled because it wasn't too bad.

2% decline on a relatively smaller sum.

Not too damaging.

Thanks to strong Q2 and Q3 numbers, full year 2023 registered an improvement.

Q2 and Q3 saw larger percentage gains on relatively larger numbers, after all.

Everything taken into consideration, pretty decent.

Full year 2023 saw a 12% increase in income generated by my investment portfolio, year on year.

Total amount:

$231,495.19

This compared to $205,999.73 for full year 2022.

To new readers of my blog, this is probably all very impressive.

However, readers who have been following my blog for many years would know that blog posts like this is more to inspire than to impress.

If AK can do it, so can you!

I am not just saying this.

I mean it.

It is about being prudent with money.

It is about keeping our needs simple and our wants few.

It is about being patient and getting rich slow.

It is about being pragmatic and staying invested in bona fide income generating assets.

If it all sounds very boring, well, it is.

It is all about staying grounded and marching towards that pot of gold we know is waiting for us to unearth.

Unearth?

That sounds like work.

Yes, it is.

There is no free lunch in this world.

It is not about going after what could be there but what we know is there.

So, what is my strategy for 2024?

More of the same, really.

I expect my investment portfolio to continue generating income for me this year, barring earth shattering events.

If another pandemic strikes or if war happens on a global scale, expect income generation to slow down or stall.

I can only hope that sanity prevails and that more people in power are willing and able to avoid war on a larger scale.

War is fully avoidable unlike pandemics.

Unfortunately, many human beings are selfish and narrow minded.

When they are put in positions of powers, they could then influence the gullible to do the unthinkable.

This is not a problem exclusive to less developed countries or politically less stable regions in the world, of course.

I am spending some time to talk to myself about this because compared to economic challenges, this is a bigger problem.

Where economic challenges are concerned, high inflation has been tamed or so it seems.

Expectations are for interest rates to start declining sometime this year and there are some experts who think that the Fed will bring interest rate down to under 3% in order to ensure a soft landing.

This is good news for REITs, especially those which are highly leveraged as well as those which have a big part of their debt on floating rates.

For banks, it would mean moderating earnings as rapid interest rate hikes end a strong tailwind.

Still, banks have proven again and again that they have been able to deliver earnings growth over time.

So, staying invested is what I will do.

Before I end this blog post, I will remind myself of the following.

"There will come a day when my passive income generated exceeds my earned income doing what I do.

"If I have always been prudent with money, that is probably the day I become financially free.

"That is when I no longer have to work for money."

No more unearthing to do.

So, believe me when I say this.

If AK can do it, so can you!

Posted by AK71 at 11:54 AM 14 comments

Labels:

passive income

$3K CPF MA Top Up in 2024 to new BHS.

Friday, January 5, 2024

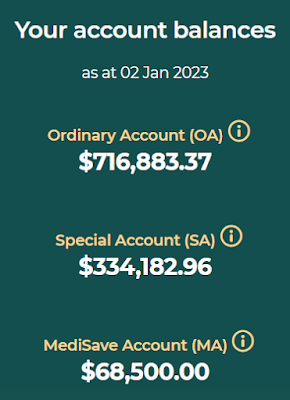

Like I shared in a recent blog post, the new Basic Healthcare Sum is $71,500 which is an increase of $3,000 from $68,500 in 2023.

This was what my CPF statement looked like at the start of 2024:

After doing the Top Up of $3,000 using PayNow, this is what my statement looks like now:

I decided to do the Top Up earlier than later in the month because I might forget.

Growing old and forgetful.

For those who are not forgetful like me, doing the Top Up a few days before the end of January would mean making a little more in interest income in a savings account.

If AK can do it, so can you!

However, sometimes, it is better to do it your way!

Of course, for those who are still gainfully employed, doing this will also get income tax relief.

It is a win and a win again!

Finally, a question from a reader is worth reproducing here:Reference:

Why top up CPF MA?

Recently published:

CPF savings, SSBs and T-bills...

Posted by AK71 at 10:32 AM 0 comments

Labels:

CPF

CPF savings, SSBs & T-bills in January 2024.

Wednesday, January 3, 2024

Last year, I published a blog post with a very eye catching title regarding my CPF savings.

"More than $1.1m in CPF savings!"

Well, this time, it is a whimper, in comparison, at less than half a million dollars. ;p

So, how much exactly?

Here is my CPF pie chart at the end of 2023:

Some readers might say that for the first time in a long time, my CPF savings look "normal." ;p

CPF OA savings less than CPF SA savings.

For people who use most of their CPF OA savings to fund a flat purchase, this is probably normal.

Of course, regular readers of my blog would know that most of the money in my CPF OA went to buying T-bills.

Two T-bills.

A one year T-bill is maturing end of this month.

A six months T-bill is maturing in the middle of March.

So, the money will come back.

I will transfer the money from the CPF IA to the CPF OA when it happens.

Then, if yields stay relatively high, I would probably buy T-bills again.

Of course, with CPF funds, I do competitive bidding.

3.5% p.a. is a reasonably sensible bid to place.

I produced a video on this topic before too and, in case some are interested, here it is:

Hope the video is helpful.

Of course, another reason why my CPF savings did not grow as quickly as before was because I did not do voluntary contributions last year.

The money earmarked for that went to buying Singapore Savings Bonds instead which offered higher than 3% p.a. in 10 year average yield.

For those who didn't know this, here is the link to the blog post:

I won't be doing voluntary contributions to my CPF account this year in 2024 either.

Why?

I front loaded the "contributions" last year, buying more Singapore Savings Bonds later in the year.

See this blog post:

All as well.

The latest Singapore Savings Bond is offering only 2.81% p.a. in 10 years average yield.

So, that is an easy skip for me.

In any case, I am in no hurry to buy more Singapore Savings Bonds since whatever I want to buy to replace voluntary contributions to my CPF account in 2024 was filled last year.

If the yield remains low for the rest of the year, I will go back to doing voluntary contributions to my CPF account in 2025.

Easy.

Till the next blog post, mask up and stay safe!

If AK can do it, so can you!

Posted by AK71 at 4:38 PM 0 comments

List for 2024! CPF BHS. T-bills. 2023 passive income.

Monday, January 1, 2024Happy new year!

Posted by AK71 at 9:20 AM 17 comments

Labels:

bonds,

CPF,

passive income

SSB, T-bills, DBS and UOB. Plan for December. Easy.

Sunday, December 3, 2023

This is probably going to my final blog post for 2023.

Planning on taking it easy for the rest of the month when it comes to social media.

Have been a little too active in the last few months on YouTube.

Now, going to spend more quality time with myself.

Being able to play three games everyday on my new gaming laptop makes me very happy.

That is what retirement is about.

It is about being happy.

A few things to talk about.

1. T-bills and SSB.

The Singapore Savings Bond being offered this month is offering a stunning 3.07% p.a. 10 year average yield.

Stunning for the wrong reason since last month's offer gave an attractive 3.4% p.a. 10 year average yield.

I think I will give this one a miss.

Am I veering away from my plan to keep buying Singapore Savings Bond as long as the yield is above 3% p.a. or not?

Well, the plan was to replace CPF Voluntary Contributions with Singapore Savings Bonds.

I have already done it with money meant for the CPF in 2023 and 2024.

2025 is work in progress and there is really no hurry.

In the meantime, I will continue to strengthen my T-bill ladder.

The last T-bill auction had a cut-off yield of 3.8% p.a.

Hopefully, it stays there for the auctions happening this month too.

2. DBS and UOB.

I still want to increase my investment in the local banks.

OCBC is already a very large position.

So, the idea now is to grow my positions in DBS and UOB.

For me, the stock prices to add would be between $30 to $30.50 for DBS and closer to $26 for UOB.

3. Taking it easy.

I have been thinking of taking it easy when it comes to investing for some time.

However, after a recent recording with The Fifth Person, I have been thinking about it even more.

The decision to retire early was a big step for me.

I was always a worrier and I still am a worrier.

Still, I convinced myself that I had sufficient financial resources to retire early.

Then, in retirement, I began to question if I really did have enough.

I continued to invest for income and increase my passive income in retirement.

In recent years, I have been telling myself to take it easy and that I have enough financial resources not to have to worry.

I have had some success but something Adam said during the recording hit home.

So, I could simply just buy more Singapore Savings Bonds and T-bills from now on and still be quite comfortable.

Risk free and volatility free.

Don't have to do anything else.

This would be another phase in my life, if I should do this.

To be honest, I rather like it.

Anyway, that's all the talking to myself for now.

If AK can talk to himself, so can you!

Merry Christmas and Happy New Year!

Unemployed AK grew his passive income from $100K to $200K per year.

Sunday, November 26, 2023

I thought of making a video out of this but I am feeling a little under the weather.

So, I decided to blog about this instead while the thought is still fresh on my mind.

Something I do regularly is to blog about my passive income.

It is a digital record of not only the numbers but also my thoughts at those different points in time.

Of course, the blog posts are also to inspire readers.

Hopefully, more regular folks like me would make investing for income a part of their journey towards financial freedom.

Yes, if AK can do it, so can you.

While having a conversation with some friends recently, they asked me how did I continue to grow my passive income while lacking an earned income in the past 8 years?

One of them reminded me how my annual passive income was closer to $100K more than 10 years ago.

Now, it is more than $200K.

It isn't something I have given much thought to.

So, what did I say?

"I am just very frugal when it comes to money which allows me to continue investing more money although I lack an earned income."

When I left the workforce, the biggest disadvantage was losing that earned income.

While still receiving an earned income, I was able to reinvest all of my passive income and also some of my earned income.

Retirement has definitely slowed the pace of wealth building.

A friend told me that being able to continue to grow my wealth even in retirement is quite impressive.

(Most people see their wealth dwindling in retirement.)

How did I achieve this?

In a nutshell, this is the beauty of investing for income.

I consume the income generated by my investment portfolio.

I do not consume my investment portfolio.

I do not eat the chicken but the eggs laid by the chicken.

However, this isn't the full story.

Remember how my friends did a CSI on my passive income and reminded me that my annual passive income was closer to $100K more than 10 years ago?

Wasn't $100K a year already enough to F.I.R.E. for someone like me?

Well, it probably was more than enough.

So, what was the problem?

I am a worrier.

Hard to change.

I needed a buffer and a significant one too.

How significant a buffer?

Well, consider this.

Even today, with inflation being as high as it is, I recently blogged about how I would probably be quite comfortable with $48,000 a year.

See how significant the buffer is?

If I had retired more than 10 years ago instead of 8 years ago, I would have had a smaller buffer.

If I had spent money more freely, the behavior would have probably carried into my retirement years.

I would not have been able to continue building my wealth to what it is today then.

For most of us, it is far easier to curb the outflow than to grow the inflow of wealth.

So, it isn't just about not eating the chicken but the eggs.

It is also about having more than one chicken or having a buffer.

Don't consume all the eggs so that we can sell some of the eggs to buy more chickens.

Of course, there were also times when buyers offered much higher prices for my chickens.

I used the proceeds to buy even more chickens.

Not all chickens thrive but most of them do.

So, how did AK the early retiree grow his passive income from $100K a year to $200K a year?

No earned income but can continue growing passive income?

Confirm and double confirm!

If AK can do it, so can you!

Related post:

Inflation, passive income and budget.

Posted by AK71 at 4:30 PM 24 comments

Labels:

passive income

Added to position in DBS. T-bill 3.8% p.a. cut-off yield.

Friday, November 24, 2023

Just a quick update on what I have done in recent days to my investment portfolio.

For anyone who is following me on YouTube, it is no secret that I have been looking to add to my investment in DBS.

I identified the immediate support to be at $32.00, and if that should break, then, $31.80 would be next.

I added to my position at closer to $31.80 a share but it is just a nibble.

I see longer term support for DBS at between $30.00 to $30.50 a share.

So, that is where I would like to buy more.

DBS continues to impress me with its much higher ROE of 18% to 20% when compared to UOB and OCBC which have ROE of around 14%.

So, I feel that this justifies DBS trading at a higher price to book.

There is also the fact that DBS pays dividends quarterly and as a retiree who lives off his passive income, this is also attractive to me.

Next topic is T-bills.

The auction happened yesterday and the cut-off yield was 3.8% p.a.

I estimated it to be 3.88% p.a. but 3.8% p.a. is good enough to make me happy.

What also makes me happy is that non-competitive bids were fully allotted.

T-bill ladder is intact!

Next auction is happening on 7 December.

So, nothing earth shattering happened, really.

Just sticking to my plan.

Always have a plan, your own plan.

If AK can do it, so can you!

Posted by AK71 at 11:41 AM 12 comments

Labels:

bonds,

DBS,

investment

F.I.R.E. Always have a Plan B! Better and cheaper!

Thursday, November 16, 2023I always say try not to be married to our jobs.

Spent money and will spend more time.

Posted by AK71 at 12:28 PM 12 comments

Labels:

ASSI,

money management

Full Retirement Sum is not enough to retire on!

Thursday, November 9, 2023

It has been quite a while since I tinkered with the CPF website.

I remember how I used to visit the website very often back in the days when I was actively plotting how to make full use of the CPF system.

Anyway, as I close in on 55 years of age, I decided to revisit the CPF website.

That is when I get a Retirement Account set up.

I thought it would be a good idea to check on how much my Full Retirement Sum would be by then.

This was what I found:

|

| Source: CPFB |

So, it would be $220,400 for me.

My CPF-SA has more than that right now and it will continue to grow based on interest earned yearly alone.

Therefore, it isn't a worry for me.

This was how it looked at the beginning of the year:

Then, I checked how much I would get when CPF LIFE kicks in for me at age 65.

For this, I used the CPF LIFE estimator: HERE.

I had to tell the AI that I am 55 years old now in order for it to work and then input the FRS for my age group.

It is a fun calculator to use because I was able to use sliders to change the payout age and also the amount of funds involved to see how things would look like.

Anyway, if I just stuck with the FRS of $220,400 and had the payout start automatically at age 70, I would be paid $2,380 monthly.

If I should request for payouts to start at age 65 instead, I would be paid $1,760 monthly.

Back in 2014, I published a popular blog post that has received almost 50,000 pageviews by now.

It was "To retire by age 45, have a plan."

In that blog post, I said that I wanted to retire by age 45 and thought I would be quite comfortable with $2,500 a month in passive income.

I accounted for inflation and by age 65, I would need $5,081 a month in passive income.

I calculated the required monthly passive income till age 75.

If you are interested to see all the numbers at various ages, please go the blog post and I have hyperlinked the title earlier.

So, what is the point I am trying to make?

For me, at least, the Full Retirement Sum is not enough to retire comfortably on.

At age 65, there would be an estimated shortfall of $5,081 - $1,760 = $3,321 a month.

Please don't get me wrong.

I think that the CPF LIFE is a very good idea because many people are not very good with money and even worse at planning for retirement funding.

So, with CPF LIFE, at least there is some kind of minimum safety net.

However, that is what it is.

A minimum safety net.

In case you are wondering what triggered this blog post, it was a news article on how Singaporeans are falling behind in savings and more can only afford basic expenses.

See article in The Business Times: HERE.

"More Singaporeans can afford only basic spending, don't have enough savings, a survey by OCBC found."

"Most do not have sufficient "emergency funds" or enough savings to meet their families' needs over the next year."

We really want to take action early to help ensure retirement funding adequacy.

During good times, don't become complacent because bad times could hit us when we least expect them to.

Always have a crisis mentality.

It might not be fun but we should do better than those who don't.

If AK can do it, so can you!

Note: Numbers are based on CPF LIFE Standard Plan.

Recently published:

3.75% p.a. cut-off yield for T-bill.

Posted by AK71 at 10:23 AM 38 comments

Labels:

CPF

3.75% p.a. cut-off yield for T-bill. Disappointing.

Wednesday, November 8, 2023

The results for the 6 months T-bill auction came out at 5pm or so.

I made a short video on this soon after.

In a nutshell, I was disappointed.

I did make a video a few days ago saying that we could see 3.88% p.a. based on the daily SGS prices and yields published by the MAS.

Of course, I didn't expect an exact match but 3.75% is even lower than the auction that took place one month ago.

That gave 3.87% p.a.

The last time it was lower was 2 months ago in September at 3.73% p.a.

Anyway, as I was using cash, I just placed a non-competitive bid.

This is so that I would get at least some of my application filled if there was a high level of interest.

Well, only 95% were allotted.

This means that if we had applied for $20K, we would get a refund of $1K.

To be fair, a cut-off yield of 3.75% p.a. is not bad.

It is still more than what most 6 months fixed deposits would pay, and if we consider the fact that the interest is paid at the start of the duration, it is actually more than 3.75% p.a.

So, disappointed I may be but not too much so.

Think positive!

Better for my mental health!

As for people using CPF-OA money, I always say to do competitive bidding because we do not want to be a victim of the unthinkable.

I have said in the past that a sensible competitive bid would be one that would not cause us to lose out on interest income in the end.

So, using CPF-OA money, the break-even is about 3.33% p.a. and since we should be aiming for more than breakeven, a competitive bid of 3.5% p.a. makes sense.

(3.33% p.a. takes into consideration the possibility of losing 8 months of CPF-OA interest.)

To be honest, unless the amount is significant, the difference in interest income is not going to be very meaningful.

I think this is not hard to understand.

So, I wouldn't be too worried if the amount of CPF-OA money involved is, say, less than $50K.

So, until the next T-bill auction, it is back to my games.

If AK can do it, so can you!

Posted by AK71 at 9:48 PM 6 comments

Labels:

bonds

SSB missions update! Redemptions! SSB I forgot I had!

Saturday, November 4, 2023

I don't usually look at my CDP statement these days because I really dislike looking at it online.

So uncomfortable.

I miss the paper statements so much.

Yes, I know the argument for going green but I am not sure that going from chopping down trees to guzzling energy in data centers is a good trade or not?

After all, we can replant trees but unless we are using renewable energy, data centers are big polluters, if we think about it.

1. SSBs

Anyway, I had to check my CDP statement just to be sure that my paper records are accurate for Singapore Savings Bonds.

As it turns out, there was a Singapore Savings Bond which I thought of buying but wasn't sure if I could.

I blogged about it but it wasn't very clear.

See:

SSB 3.06% p.a. 10 years average yield.

Well, I could not find any trace of this in my CDP statement.

Blessing in disguise, maybe.

After all, this month's offer is for 3.4% p.a. 10 years average yield.

2. SSB redemption.

I am redeeming SBMAY23 which I did buy.

That offered a 3.07% p.a. 10 years average yield.

That was bought to partially replace CPF voluntary contributions in 2024.

See:

Saving for income 3.07% p.a.

Will use the funds to apply for SSB this month.

But the funds will only come back to me next month!

How like that?

I will have to use money in my war chest first and the returning funds will go back to my war chest next month.

Like I said in the previous blog post, AK can juggle money.

3. Forgotten SSB!

While going down the list of investments in my CDP statement online, I found an SSB that I forgot I had!

This was bought in 2018!

OMG!

10 year average yield of less than 3% p.a.

Alamak!

OK, I am redeeming that too.

The funds will go to my war chest next month.

More money for T-bills, maybe.

4. SSB mission for 2023.

Anyway, this is a blog post to remind myself of what I have done and what I am doing in the SSB space.

Mission accomplished in replacing VC to CPF with SSBs in 2023.

5. SSB mission for 2024.

For VC to CPF in 2024, I am (re)applying for SSB this month with funds from the redemption of SBMAY23.

Together with another SSB purchased in March, this will (re)complete the mission for 2024.

I thought of redeeming the SSB bought in March too but I have a feeling that the SSB this month is going to be oversubscribed as well.

So, I could end up being only partially allocated if I applied for a larger amount.

Anyway, my war chest doesn't like being depleted even if only temporary.

With yields at the long end of the curve rising, like I said in an earlier blog, there is no hurry to lock in higher yields.

Famous last words? Maybe.

6. SSB mission for 2025.

If I get what I apply for this month, it would be $15K of SSBs in total for the year 2025.

Since this is a mission for 2025, I have plenty of time to complete it.

Crossing fingers that 10 year average yields for SSBs will remain relatively high.

See:

SSB 3.4% p.a. (and 6 months T-bill ladder.)

If AK can buy SSBs, so can you!

Posted by AK71 at 11:33 AM 9 comments

Labels:

bonds

Monthly Popular Blog Posts

-

It has been a while since my last blog. Hope everyone is doing well. Instead of revealing the numbers at the end of the blog, I have put it ...

-

Time for another update. First, on the personal front, I have been spending more time on other stuff in life as I have been feeling that too...

-

I thought of not blogging about my 2Q 2020 passive income till a couple of weeks later because Mod 19 of Neverwinter, Avernus, just went liv...

-

Today, Marco Polo Marine's share price rose significantly on the back of much higher volume and the recent visit by a group of investors...

-

Been a while since my last blog post. Hope everyone is staying calm as stock markets crash around the world. I produced a video last night w...

All time ASSI most popular!

-

A reader pointed me to a thread in HWZ Forum which discussed about my CPF savings being more than $800K. He wanted to clarify certain que...

-

The plan was to blog about this together with my quarterly passive income report (4Q 2018) but I decided to take some time off from Neverwin...

-

Reader says... AK sifu.. Wah next year MA up to 57200... Excited siah.. Can top up again to get tax relief. Can I ask u if the i...

-

It has been a pretty long break since my last blog. I have also been spending a lot less time engaging readers both in my blog and on Face...

-

Ever since the CPFB introduced a colorful pie chart of our CPF savings a few years ago, I would look forward to mine every year like a teena...