How did my recent application for Singapore Savings Bond go?

The application used the remaining $14,000 I originally earmarked for CPF voluntary contribution in 2023?

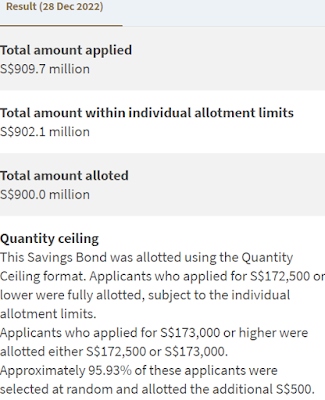

The results are out.

Fully allotted.

No need to carry forward any remaining money into the new year.

Nice!

So, money which was meant for CPF voluntary contribution in 2023 went into three Singapore Savings Bonds this year.

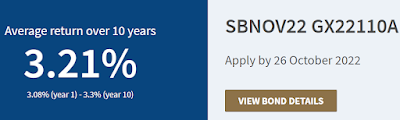

1. $10,000 with 10 year average yield of 3.21% p.a.

2. $14,000 with 10 year average yield of 3.47% p.a.

3. $14,000 with 10 year average yield of 3.26% p.a.

So, no voluntary contribution will be made to my CPF OA and SA in 2023.

For readers who do not know why I am doing this or if you want to refresh your memory, see:

Singapore Savings Bond or CPF?

Regular readers know that my plan was to continue with voluntary contributions to my CPF OA and SA at least till I turn 55 years old.

Although I still consider the CPF to be a risk free and volatility free investment grade bond that pays a reasonably attractive coupon, with higher yields, recent Singapore Savings Bonds were more attractive.

I plan to continue putting aside money at least until I turn 55 years old in order to add to this bond component in my portfolio.

However, the money might not go to my CPF account but the Singapore Savings Bond as long as the latter's 10 year average yield remains higher than 3% per annum.

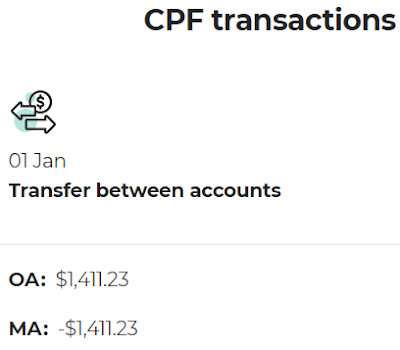

In 2023, I will still top up my CPF Medisave Account (MA) because that pays 4% per annum.

If Singapore Savings Bond's 10 year average yield should exceed 4% per annum, then, I might not top up the MA either.

However, if such 10 year bonds should pay a coupon of more than 4%, we could see the CPF SA getting its interest rate pegged to long term bond yields and not remain at 4%.

How like that?

Cross the bridge if we come to it.

Speculating now is like "on paper discuss soldier."

I am also too lazy to think too far.

Yes, I know I think a lot but that is a bit too much even for me especially in my old age.

So, does AK mean he would continue applying for Singapore Savings Bond in 2023 with money which was supposed to be for CPF voluntary contribution?

Yes, that is the long and short of it.

|

| Source: MAS |

I might even frontload and apply for Singapore Savings Bond from 1Q 2023 with money which would have been earmarked for CPF voluntary contribution in 2024.

For example, if I should have a spare $5K on hand early in the year, I could apply for Singapore Savings Bond with that $5K in 1Q 2023.

I don't have to wait till 4Q 2023 to make applications like what happened this year.

I will have more fixed income by frontloading.

I could even do more extreme frontloading by getting more than $38K of Singapore Savings Bond in 2023 if the 10 year average yield stays relatively high.

Basically, I should have another 4 times of $38K meant for CPF voluntary contribution.

That makes a total amount of $152K which could be frontloaded into Singapore Savings Bond.

This is a clue as to the number of years left before I turn 55.

Another $152K is pretty demanding and would not happen all at once.

It would happen gradually as and when I have some spare cash on hand.

Frontloading is something that the CPF would not allow, of course, with its annual contribution cap.

Anyway, that is the plan with regards to money meant for CPF voluntary contribution (for now.)

Next blog will be on my passive income for the full year 2022 and also what to do in 2023.

Likely to be published only in the new year.

Happy New Year!

Recently published:

4.28% yield T-bill.