I have been blogging about the passive income generated by my investment portfolio every quarter for many years now.

DBS, OCBC & UOB at 40% of portfolio?

1. CPF or SSB?

Have a more secure financial future in an uncertain world by creating a stream of reliable passive income with high yields.

Ever since the CPFB introduced a colorful pie chart of our CPF savings a few years ago, I would look forward to mine every year like a teena...

I have been blogging about the passive income generated by my investment portfolio every quarter for many years now.

Posted by AK71 at 1:01 PM 16 comments

Labels:

bonds,

CPF,

passive income,

savings

I remember Warren Buffett said that when he first started out as a professional investor, he had more ideas than he had money.

Later on, he had a lot more money than he had ideas.

It isn't as popularized as other things he has said before and, so, it is easy to forget.

I am probably stuck at the "many ideas but not much money" stage.

Well, I guess most of us are.

There are so many things I would like to invest in but I simply do not have enough funds to do so at least not in any meaningful way.

So, what to do?

Before going on, you might want to listen to this video I just uploaded to my YouTube channel on what Warren Buffett and Charlie Munger said:

I should pick what I think is my best idea at any one time.

I should not scatter my limited resources which is something I have been guilty of doing.

The operative phrase being "I think."

Yes, I could be wrong.

My best idea for a while now has been to invest in the banks.

So, I will latch onto that idea and further grow my exposure to the local banking sector.

As I feel DBS doesn't seem to offer as much value for money, I will grow my positions in OCBC and UOB mostly.

How am I actually going to do this?

As a retiree, I lack an earned income and I consume most of my passive income.

So, I have a harder time growing my investment portfolio.

Taking a leaf from Warren Buffett's book, the plan right now is to reduce exposure to non-bank investments on market up days and to increase my investment in the banks on market down days.

It is going to be a gradual process and will likely happen over many, many months.

I would like to see my combined investment in DBS, OCBC and UOB account for about 40% of my investment portfolio.

Now, they are at about 30%.

Having said this, to be perfectly honest, I could change my mind partway as I am pretty satisfied that my portfolio right now is able to bring home sufficient bacon.

I am also not wired like Warren Buffett or Charlie Munger and might not be able to see this through.

If you agree with me, beware, you might be mental just like me.

If you disagree, you could be right and I could be wrong.

Just talking to myself, as usual.

Posted by AK71 at 11:11 AM 27 comments

Labels:

DBS,

investment,

OCBC,

UOB

I have published a series of blogs in recent years which listed my largest investments and sometimes shared the reasons for me investing in those assets.

This blog is going to talk about those largest investments in my portfolio but it will have a little twist.

I have always said that as an investor for income, the most important thing we want to see from our investments is the ability to generate income sustainably and a willingness to share that income generated with us.

I produced a YouTube video to talk about this and for those who are not subscribed to my YouTube channel, this is the video:

There are people who are worried about capital loss and that passive income generated from our investments is unable to cover the capital loss.

They might find it odd why AK is not concerned about this?

Well, to me, capital loss when it is on paper isn't at all damaging unless we are using money that we shouldn't be using to invest with.

Recall what Warren Buffett said about tide going out and we see who has been swimming naked.

Two groups of people should be very worried about capital loss on paper.

1. People who are using leverage might get hit by margin calls as the market value of their investments decline.

2. People who are using money they need for other purposes in the next few months or years as they might have to liquidate at a loss.

If we are not in the same situation as these people, I don't see any good reason to worry.

We just have to make sure that what we are invested in are bona fide income generating assets and that they will still be generating income for us for a long, long time to come.

What to avoid?

Remember, no one cares more about our money than we do and if it sounds too good to be true, it could well be.

Now, for the twist.

This is not something I think is meaningful but it might be fun reading for some people in a perverse way and it could also make some people feel better.

How so?

They are not the only ones losing money (on paper.)

OK, here goes.

$500,000 or more

CPF

When equities do badly, we appreciate the CPF a lot more.

CPF might generate "only" 2.5% to 5% per annum in return for us but we won't ever suffer any capital loss.

Of course, the Singapore Savings Bond is now a good alternative to CPF as interest rate has risen significantly and I blogged about this recently.

There is always a place for such risk free and volatility free alternatives in our portfolios as they could also outperform during bear markets.

$350,000 to $499,999

AIMS APAC REIT

IREIT Global

OCBC

AIMS APAC REIT is an example of how staying invested in bona fide income generating assets through ups and downs in the stock market can only be a good idea.

My investment in AIMS APAC REIT is free of cost for some time now, still generating regular income and also very much in the black.

IREIT Global which has a shorter history, on the other hand, is very much in the red.

However, I do not see anything wrong with the fundamentals and, if anything, at the current price, the REIT offers even better value for money.

I expect IREIT Global to continue generating meaningful income for me and I will stay invested.

OCBC became my largest investment in the local banking sector a few months ago as I averaged up.

Although I averaged up, my investment in OCBC is still very much in the black.

Just like DBS and UOB, OCBC is a reliable income generator which is my primary consideration as an investor for income.

$200,000 to $349,999

ComfortDelgro

DBS

UOB

Wilmar International

ComfortDelgro joins IREIT Global as an investment that is suffering a paper loss in my portfolio since most of the investment was made between $1.90 to $2.00 a share a few years ago.

However, ComfortDelgro is more likely than not going to continue generating an income for me as long as we are not hit by another disaster as damaging as the COVID-19 pandemic.

There is no reason not to stay invested especially when I expect things to improve.

My investments in DBS and UOB, just like my investment in OCBC, are very much in the black.

Whatever I said about OCBC would apply to DBS and UOB as well.

My investment in Wilmar is also in the black (for now.)

Wilmar has shown itself to be a reliable income generator over the years but, to be honest, I am staying invested in Wilmar also because I think it is extremely undervalued.

So, there is a bit of an asset play angle.

$100,000 to $199,999

Sabana REIT

Capitaland China Trust

Frasers Logistics Trust

My investment in Sabana REIT is very much in the black as most of the investment was made when the low ball offer by ESR REIT was rejected.

Sabana REIT is undervalued and because their assets are all in Singapore, there is no worry about foreign exchange issues unlike IREIT Global.

My investment in Capitaland China Trust is, however, in the red but just not as red as IREIT Global.

My investment in Frasers Logistics Trust is very much in the black just like my investment in AIMS APAC REIT but it isn't free of cost yet.

I expect Sabana REIT, Capitaland China Trust and Frasers Logistics Trust to continue to generate income for me.

In fact, I do not see any of my largest investments not generating income for me at least in the next few years.

Three of my largest investments are trading at below my average prices but that doesn't bother me as long as they do the job I expect them to do.

On a portfolio level, I am not doing too badly.

Yes, don't put all our eggs in one basket.

When would I be worried?

As an investor for income, I think about whether my investments are able to generate the income I expect from them.

So, if an asset should give me good reason to think that it is unable to reliably generate an income for me, I would worry.

Don't be too optimistic.

Have a meaningful percentage of our portfolio in fixed income.

Don't be too pessimistic.

Stay invested in equities that will likely deliver better returns than fixed income in the long run.

Be pragmatic.

There are worse situations to be in than being paid regularly while we wait for things to improve.

I hope everyone feels better after reading this blog but of course this is rather unlikely.

How are you feeling after reading this blog?

Recently published:

1. CPF or SSB? No brainer.

2. 3Q 2022 passive income.

References:

1. Worried as dividends and interest income reduced.

2. Largest investments (2Q 2022.)

Posted by AK71 at 7:28 PM 13 comments

Labels:

investment

Regular readers know that I have been doing voluntary contributions to my CPF account every year.

I consider the CPF a special investment grade bond that is risk free and volatility free while paying relatively attractive coupons of 2.5% and 4%.

The plan was to continue doing maximum voluntary contributions till I turn 55.

In my age bracket, a bigger percentage of my voluntary contribution would go to my SA which enjoys a 4% interest rate.

Approximately, 31% of my voluntary contribution would go into the SA while the rest goes into my OA.

What about the MA?

My MA is usually maxed out while my SA has already exceeded the Full Retirement Sum (FRS) and, so, what is supposed to go into my MA would flow into my OA instead.

However, with interest rates rising, I have been keeping an eye on the Singapore Savings Bond.

The effective interest rate for my voluntary contributions to my CPF account for the next few years is about 3% per annum which is an averaging of the interest rate for the OA and SA by contribution proportion.

It is a no brainer that if I am able to get more than 3% from another risk free and volatility free instrument, it would trump the CPF even for my age bracket.

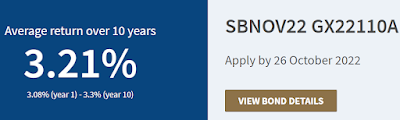

SSB is now offering 3.21% per year.

Even if we were to hold for only 1 year, it will pay 3.08%

|

| Source: MAS. |

So, I will be applying for the SSB closing on 26 Oct for a sum of $38,000 or a rounding up of $37,740 (i.e. the CPF annual contribution limit) which has been earmarked for voluntary contribution to my CPF account in the new year.

As I expect the level of interest in this SSB to be rather high, my application is probably only going to be partially filled.

In such an instance, I will use the refunded money for future SSB applications if the coupons remain higher than 3%.

Again, what about the MA?

The plan is still to do a top up to my MA in the new year to hit the new Basic Healthcare Sum (BHS) as that enjoys a 4% interest rate.

However, if the SSB coupon should exceed 4% before then, I will channel the money earmarked for my MA to the SSB instead.

So, it seems that I will either be making a smaller contribution to my CPF account in 2023 or not at all.

The big picture really has not changed.

I am still growing the risk free and volatility free investment grade bond component of my portfolio.

However, the interest earned in the SSB is not retained and compounded unlike the CPF.

I must be prudent and put the interest earned to work and not consume it.

So, CPF or Singapore Savings Bond?

Same, same but different.

References:

1. 2022 CPF contribution and top up.

2. $1.1m in CPF savings!

Posted by AK71 at 6:05 PM 18 comments

Labels:

bonds,

CPF,

investment,

savings

In my last quarterly passive income update, I said that I was too active as an investor for income in 2Q 2022 and that I was looking forward to being lazy again.

Did I get to be lazy in 3Q 2022?

Well, I almost did nothing until I added to my investments in IREIT Global and a Chinese tech ETF in September as their prices declined pretty dramatically.

Although Europe's economy is likely to go into a recession, IREIT Global's numbers are strong and unless we expect their tenants to default en masse, it is hard to justify such a dramatic decline in unit price.

Doing a bit of investigation told us that a substantial shareholder, AT Group, was probably responsible for bulk of the selling and Mr. Market simply could not absorb so much in such a short time.

I see a weaker Euro, higher interest rates and a longer time to backfill vacated premises as reasons for some weakness but not a 20% decline in unit price.

Mr. Market oversold.

So, I had to buy more at 50c a unit.

It was a good bargain, in my opinion.

Any price under 50c a unit would be a steal, all else being equal.

I would most likely be buying more then.

As for Lion-OCBC Hang Seng Tech ETF, regular readers would probably remember that I said it was an experiment for me.

I am an ignoramus when it comes to tech stuff.

My position in the ETF is still less than 1% of my portfolio's market value although I bought more recently.

The position might grow a bit especially if the unit price declines to test the low of 15 March but it is unlikely to grow much bigger.

One reason why it is likely to stay relatively small is because the ETF does not pay a dividend and I have to trade to make some money from it.

Sounds like work, doesn't it?

Too much work for me.

Yes, AK is lazy.

OK, maybe, AK being lazy is the main reason why the position is staying small.

Alamak, ownself poke ownself.

Anyway, in my 2Q 2022 passive income report, I also said that I expected my passive income in 3Q 2022 to come in weaker year on year.

The reason is simple.

In 3Q 2021, there was a pretty significant one time final distribution from Accordia Golf Trust which, of course, is no more.

That final distribution represented a big chunk of my passive income received in 3Q 2021.

So, missing that, there was a big hole that must be filled in 3Q 2022.

Although I expected that changes I made in recent months would pick up some of the slack, I was not sure that the hole could be completely filled.

It was a case of hope for the best but prepare for the worst.

I wasn't expecting a tragic outcome but I wasn't expecting something to celebrate either.

I was crossing fingers and toes.

Then, with the weakening Euro, it became quite clear that IREIT Global's distribution would come in lower compared to 1Q 2022 and it did by about 10%.

Yikes!

Double whammy!

As if things were not looking gloomy enough already, Mr. Market poked me in the ribs.

What to do?

I was basically digging in for a weaker 3Q 2022.

So as not to set myself up for disappointment, it was the sensible thing to do.

Then, the moment of truth.

The once per quarter login to my bank account to check on the dividends received.

My jaw dropped.

OMG!

I must have done something right because 3Q 2022 passive income came in higher than in 3Q 2021!

3Q 2021 passive income:

$69,145.13

3Q 2022 passive income:

$75,989.50

I would have been quite amazed even if there had been no decline in 3Q 2022 passive income year on year.

However, 3Q 2022 passive income increased by almost 10% year on year instead!

OMG!

Mind boggling!

I so stunned like vegetable!

When I blogged about my 2Q 2022 passive income, I titled the blog "Stronger with changes."

It seems that the changes I made have strengthened my passive income in 3Q 2022 as well.

Forget spinach, I feel like eating some broccoli now!

Eat broccoli!

Makes passive income strong!

OK, be serious, AK.

If you are new to my blog or cannot remember the changes I made to my investment portfolio, you might be interested in reading these blogs:

1. Reallocate as interest rate rises.

2. 2Q 2022 passive income: Stronger with changes.

Having read those blogs again myself, I am really glad I wasn't too lazy to do what I did.

My full year passive income in 2021 was:

$171,854.30

I titled that blog "Don't lose hope."

See:

4Q 2021 passive income: Don't lose hope.

Passive income in the first 9 months of 2022:

$ 180,667.92

Already 5% higher than passive income for the whole of 2021, with 3 more months to go, 2022 will probably be ending on a high note, barring unforeseen negative events.

Investing for income allows me to be lazy most of the time.

Once in a while, I have to take time off from my life in virtual worlds to work on my investment portfolio in real life.

The world is in a mess now but I am staying invested for income.

Stay on the path to financial freedom.

Mostly investing in bona fide income generating assets can only help.

Don't stray especially when things look bleak.

It is when things look bleak that people give in to despair.

Don't give up.

Never give up.

Soldier on and we will be rewarded in good time.

Of course, it is never my way or the high way.

If you like my way, then, remember, if AK can do it, so can you!

Believe it!

Gambatte!

Recently published:

1. IREIT Global: Short term pain.

2. Chinese tech, IREIT, CPF etc.

Posted by AK71 at 11:06 AM 33 comments

Labels:

passive income

On 7 June, I blogged about trading Chinese tech stocks for pocket money.

Back then, Chinese tech stocks experienced uplifts in their prices and I sold some of my units in Lion-OCBC Hang Seng Tech ETF.

What?

AK invests in tech stocks?

Alamak, this must be AK's long lost evil twin blogging!

Anyway, in case you don't know, read:

Investing in Alibaba and Tencent.

I added to my position twice in the ETF in the months leading to 7 June.

The ETF does not pay a dividend and it is not a good fit for the purist income investor.

So, for me to make some money from the ETF, I have to trade which was what happened on 7 June.

See:

Pretty decent capital gains.

With the ETF's unit price having declined rather significantly, I decided to add to my reduced position.

I placed an overnight BUY order at a price lower than my average price and it was filled early this morning.

It was slightly lower than the price which marked the lowest point of the double bottom pattern which formed in April and May.

Technically, the ETF is oversold but it could, of course, stay oversold for a while.

I do not see a positive divergence as the MACD has not formed a higher low.

So, the ETF could see its unit price drifting lower or going sideways for a bit.

Could we see the low of 15 March retested?

If that should happen, I hope I would be brave enough to buy some.

Apart from this purchase, I also added to my investment in IREIT Global at close to 50c a unit earlier in the week.

Mr. Market seems to have taken some medication and depression has stabilized.

Still, Mr. Market could get another bout of anxiety and, everything else being equal, I will most probably get more IREIT Global on the cheap then.

The only thing holding me back now is the fact that the new year is coming in about 3 months.

I need to set aside $40,000 to make voluntary contribution and top up to my CPF account.

It might sound like I am complaining but I really am not because, to me, the CPF is a risk free and volatility free investment grade bond.

At my age, having a meaningful investment grade bond component in my investment portfolio is sensible.

My significant CPF savings provides certainty and peace of mind.

I know things are looking pretty bad in more ways than one and on many fronts.

However, we have to soldier on as even the darkest night will eventually pass.

If AK says so, it must be so. ;p

Gambatte!

Recently published:

IREIT Global is a bargain.

References:

1. Inflation, passive income and budget.

2. CPF money is not our money?

3. $1.1 million in CPF savings.

Posted by AK71 at 10:08 AM 11 comments

Labels:

China,

CPF,

investment,

IREIT

This blog is my reply to a reader's comment on IREIT Global.

Unlike bonds which have fixed coupons, REITs are able to command higher rents in an inflationary environment but it is important to see if they can do this in a timely manner.

Most of IREIT Global's leases are linked to the CPI and higher inflation automatically leads to higher rental income while others are reviewed once cumulative inflation exceeds a 10% threshold.

So, IREIT Global is able to increase rental income in a timely manner.

In the meantime, higher interest rates will not impact IREIT Global's cost of doing business as their debt is fully hedged until late 2026.

Unlike most other S-REITs, IREIT Global only pays out 90% of its distributable income which is an important factor when we consider the resilience of the REIT which is reflected in its financial numbers.

So, for quite a while at least, these are not things to be concerned about.

The question to ask now is whether the backfilling at Darmstadt Campus which will be vacated by Deutsche Telekom in November 2022 is going well as that represents 10% of the REIT's income?

To be realistic, although IREIT Global has a very good track record at getting new tenants and filling vacancies, I expect the backfilling to be slower and possibly patchy in this instance with the situation in Europe the way it is.

With IREIT's relatively low gearing level of 30.8%, however, they can take temporary setbacks even of such a magnitude.

The REIT's numbers are strong and with everything else being equal, if the possibly reduced DPU of 3.5c or 3.4c which will give us a distribution yield of 6.53% to 6.73% at 52c a unit is attractive to an investor, then, it is a buy especially if it is just to get a foot in.

Personally, I am waiting to add to my position in the REIT at under 50c a unit which might or might not be rock bottom but I would consider any price under 50c to be a steal.

Of course, it might or might not happen.

I like to think that I know IREIT Global quite well.

Fear is driving people to sell at depressed prices and if it gets any worse, it is another great buying opportunity.

Short term pain for long term gain.

References:

1. What to do when down 25%?

2. Why AK invests in REITs?

Posted by AK71 at 8:10 AM 26 comments

Labels:

investment,

IREIT

This is going to be a short blog to touch base with readers.

Quick update, basically, to let folks know I am alive and kicking (butts in virtual worlds.)

I have been busy gaming in Neverwinter and Genshin Impact but, mostly, I am spending time playing RISK Global Domination now.

That is the ultimate time killing game as one game could go on for hours just like the board version of the game!

Anyway, for readers who are not just following my blog but also my blog's comments section, they would know that I am still around as I reply to comments usually within 24 hours.

For readers who are following my baby YouTube channel, they would also know that I am still around as since my last blog in middle August, I have uploaded 5 videos.

My videos are more like audio books which last a minute or so which means you don't have to watch them, only listen.

For examples:

It is pretty easy to produce such videos.

If you are interested in the other recent videos, hop over to my YouTube channel: AK's channel.

The world is in a mess now and everybody is hurting one way or another.

Just remember that no one cares more about our money than we do.

Stay prudent with money.

As long as we are invested in bona fide income generating assets and as long as we are investing more and speculating less, we should do better than most people.

Gambatte!

References:

1. CPF money not our money?

2. Lost $300K staking crypto...

Posted by AK71 at 9:48 AM 11 comments

Labels:

ASSI,

CPF,

passive income

This is a commentary on a commentary by Keith Yap, a graduate of Economics & Development from Lee Kuan Yew School of Public Policy.

OK, that was just AK being cheeky.

AK is not learned enough to write a commentary.

AK only talks to himself.

It was a rather interesting article in CNA and anyone who is interested can read the full article titled

"By wanting to retire early, millenials are subverting conventional ideas of work and finances": HERE.

It says most millenials want to achieve financial freedom in order to retire early.

Many millenials do not enjoy the work they do and they want to achieve F.I.R.E. so that they can choose to do what they truly enjoy without having to worry about the lack of an earned income.

The desire to achieve financial freedom also stems from a greater feeling of financial insecurity, economic malaise and the heightened inflation we are experiencing now.

It also says that adherents of F.I.R.E. aim to save 70% or more of their full-time income and that the ultimate aim is to save 25x of one's annual expenses and make 4% annual withdrawals for living expenses.

Meticulous planning, extreme frugality and common sense investing are all things which characterize the F.I.R.E. movement.

OK, at this point, long time readers might be asking:

"Alamak, is Keith writing AK's biography?"

Spooky!

See:

Save 100% of our take home pay!

However, I think that saving only 25x of our annual expenses seem a bit risky.

AK is very kiasu.

See:

To retire by 45, start with a plan.

and

So, to the F.I.R.E. Padawan reading this blog, be kiasu a bit and build a buffer.

Seriously, you won't regret having a buffer but you might just regret not having one.

If AK didn't have a buffer, AK might be sending out job applications now.

See:

Before I continue, in case some think that AK might be making a mountain out of a molehill, the article in CNA cited a TODAY Youth Survey done in 2021 that found 59% of respondents between ages 18 and 35 said having enough funds to retire early is a top indicator of material success!

Wow!

That is so different from when someone told financially independent AK that he should be ashamed of himself!

Unintentionally or shamelessly giving myself a pat on the back?

You say lor.

See:

Financially free AK should be ashamed!

The article went on to say that if the prices of cars, housing and daily household goods continue to rise, millenials are likely to delay marriages, home ownership and having children.

Millenials would focus instead on securing their own financial independence.

Wow!

Good call!

AK claps for you!

See:

A happy marriage is worth waiting for.

There is a Chinese saying that goes:

先苦后甜Bitter now, sweet later.

Work hard now and enjoy the fruits of our labor later.

See:

Three attributes of a wealthy peasant!

Some people might tell me that F.I.R.E. is not the way to live life but it is my life.

F.I.R.E. is not just something personal but it is also about being socially responsible.

People who have achieved F.I.R.E. are not a burden to the society unlike people who are "lying flat."

See:

Lying flat is not financial freedom!

Of course, if striving towards F.I.R.E. makes us miserable, then, we might have to take a step back.

Look at what we are doing and see if we might have to cut ourselves some slack.

Anyway, I am happy to find out that so many young people are working towards F.I.R.E. in Singapore.

A big hurrah for everyone working towards F.I.R.E.

If AK can do it, so can you!

Recently published:

1. ComfortDelgro or SIA?

2. $300K lost in crypto staking.

Reference:

7 blogs on AK the investor (including secret of my success.)

Posted by AK71 at 3:28 PM 11 comments

Labels:

money management,

passive income

This has been a crazy week in real life while virtual life has been somewhat placid.

Still waiting for Genshin Impact's new nation with the element of Dendro to go live and also waiting for Neverwinter's new mod.

It is partly my fault for going through new gaming content as quickly as I do but I am a full time gamer first and a retiree second.

What to do?

So, I have been playing RISK a lot online recently!

Yes, I was surprised to find that I could play RISK online with people around the world and it has been pretty amazing.

Anyway, with real life matters demanding a lot more attention from me this week, I didn't have a lot of time to read the news.

Catching up.

Today, I am happy to read that ComfortDelgro is recovering nicely as expected.

First half profit is up significantly and even the taxi business reported an increase of 18% in profit.

There was a one off gain from a sale of asset and the company is going to pass the gain from the sale to shareholders.

What I like about this is that it will be a standard practice from now on.

An interim DPS of 2.85c and a special DPS of 1.41c were declared.

Posted by AK71 at 9:55 AM 10 comments

Labels:

ComfortDelgro,

investment,

passive income,

STE

I was taking my usual break from gaming and doing my 10,000 steps with some stair climbing thrown in when I decided to give some thought to how inflation is going to affect how much passive income I need.

To be honest, it isn't something I must really think about because, off the top of my head, I think I have sufficient buffer but once I think about something, I must have closure.

OCD.

Inflation is preferred to deflation which is why central banks in USA, Europe and Japan were trying so hard for so long to get inflation going.

Well, be careful what we wish for.

A cute little thing can become a monster just like that carnivorous plant in Little Shop of Horrors.

Audrey, if I remember correctly.

Anyway, now that inflation has become pretty ugly, we hear people complaining all the time.

If I had remained a wage slave, I would be crying blue murder, for sure.

What is a wage slave?

See:

Wage slavery.

We are lucky that in Singapore, higher inflation isn't as horrible as in some other countries.

Even the USA is experiencing inflation of close to 10% which is pretty bad.

So, roughly, if my portfolio is able to generate 10% more in passive income, I should do OK.

Last year, my passive income was $171,854.30.

So, 10% more means that this year, I should need $189,039.73!

Alamak, very stressful like that.

Not like this lah.

Anyway, regular readers might remember that back in late 2019, I had a pretty lengthy blog in which I revealed how much passive income I needed.

It was $120,000 a year.

$40,000 for my own expenses.

$40,000 for parental support.

$40,000 for voluntary contribution to my CPF account.

It has been almost 3 years since that blog.

So, seems like it is overdue for an update.

Yes, AK is lazy.

Tell me something I don't know.

I will start with the easiest one which is CPF.

Inflation doesn't affect the amount I must set aside to contribute to my CPF apart from the annual increase in the BHS.

So, I think increasing the amount from $40,000 to $41,000 is probably reasonable.

As for my own expenses, I think I will be generous and I am increasing the amount from $40,000 to $48,000 or a 20% increase.

This is more than enough to offset any inflationary pressure for this year and the next, I hope.

The same will go for parental support.

This means that I will have to set aside a total of $48,000 + $48,000 + $41,000 = $137,000 per year from my passive income this year and probably the next.

1H 2022 has delivered a total of $104,678.42 in passive income.

Unless something really terrible happens, 2H 2022 should not have a hard time bringing home the bacon.

Being a retiree, I don't have a kind hearted boss to give me a salary increment to help with inflation.

Have to myself help myself.

Fortunately, consistently investing for income means I am able to do this.

Of course, putting aside more passive income means that I will have less money to invest with.

Still, I am not complaining because early retirement is my choice and I am enjoying it very much.

Hard to believe but it has been 6 years.

I know what some will say about how we must look at real income and not nominal income.

So, if inflation goes up by 10%, our nominal income must increase by 10% too or else we are losing purchasing power.

Like I said earlier, it is so stressful to think like this but it is unfortunately true.

Those who are marginally financially free could fall off the cliff and might have to go back to work.

I am fortunate that 1H 2022 passive income increased 28% year on year which means that my purchasing power has not been compromised.

Hopefully, the inflationary storm does not worsen from here but even so, if I remain prudent financially, I shouldn't have to worry (too much.)

In my retirement, without an earned income, if I am able to meet all my financial obligations with my passive income and still be able grow my wealth even by just a little every year, I am happy enough.

Recently published:

1. Our CPF money is not our money...

2. Lost $300K in cryptocurrencies...

References:

1. Largest investments updated.

2. CPF savings in 2022.

Posted by AK71 at 9:10 PM 10 comments

Labels:

CPF,

investment,

passive income