A friend told me that a friend of his is desperate for reassurance regarding her investment in this REIT. Reassurance? I was baffled why his friend needs reassurance. Then, he explained that it is because there were massive sell downs at 21.5c in recent sessions, yesterday inclusive.

I told my friend I was happy that there was a sell down yesterday because my overnight BUY queue at 21.5c was filled. Well, his friend's overnight BUY queue was filled too at 21.5c but she's worried now. I find that mind boggling. We put in an overnight BUY queue in the hope that it would be filled and when it was filled, we worry? Something is wrong here. I think popping the champagne could be overdoing it but some happiness is more appropriate, don't you think?

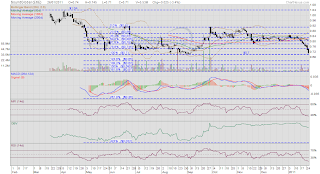

A quick look at the daily chart shows immediate support at 21.5c. The MFI is still uptrending and is now testing resistance at 50%. The confluence of 20d, 50d and 100d MAs at 22c makes this price level a strong resistance. What is the chance of this resistance being taken out?

Let us take a look at the weekly chart for clues on the longer term trend. The trend is obviously still up. If we think of the white candle formed in the week of 13 Sep, could we be seeing the formation of a flag? Is price consolidating before moving up further?

Now, look at the Bollinger Bands and they are definitely narrowing. So? Volatility is reducing which supports the idea that price is consolidating. Will price go up or down? An educated guess is that it is more likely to go up than to go down because the upcoming DPU is likely to increase over the last one by a large margin. Numbers are likely to improve and we will know for sure next week when the results are announced on the 25th (Tuesday).

Does this mean that price would not weaken at all in the meantime? Who can say for sure? However, in view of the fact that the REIT is on a longer term uptrend and that the rising 50wMA is at 21c, I have already put in a BUY order at 21c and if this price level was ever tested, I hope my BUY order could be filled. At 21c and an estimated DPU of 2c per year, that is a distribution yield of 9.52%.

Finally, someone told me that his broker advised him against investing in AIMS AMP Capital Industrial REIT because it has been losing money for years. I find this baffling as the REIT is only slightly more than a year old since the old MI-REIT was recapitalised.

Looking at the last quarterly report, we see positive net income and positive cash flow. MI-REIT is a thing of the past, AIMS AMP Capital Industrial REIT is a much stronger outfit and I am putting my money where my mouth is.

See

2Q FY2011 Unaudited Financial Results here.

Related posts:

AIMS AMP Capital Industrial REIT: Sell down at 21.5c.

AIMS AMP Capital Industrial REIT: Revised DPU and fair value.